What is a Credit Score?

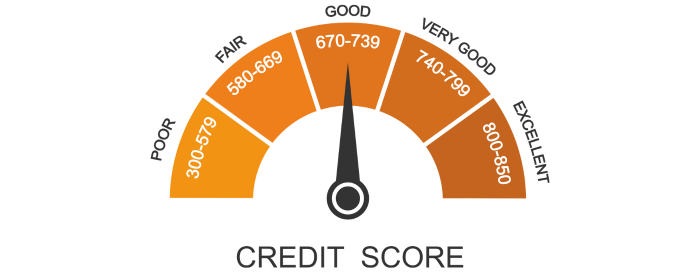

- Our credit score is a vital key that unlocks financial opportunities. This three-digit number, typically ranging from 300 to 850, serves as a measure of your creditworthiness in the eyes of lenders. In simple terms, the higher your score, the more likely they believe you are to repay your debts.

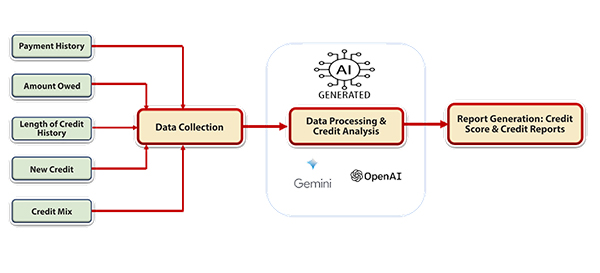

- The five most important factors that influence your credit score are payment history, amounts owed, length of credit history, new credit, and credit mix.

- Credit bureaus, like TransUnion CIBIL, Experian, CRIF High Mark, and Equifax, act as financial historians, meticulously collecting and analyzing your past credit activity.

- Building a good or excellent credit score isn’t just about bragging rights. It offers a tangible advantage when seeking loans and credit cards. With a solid score, you’re more likely to qualify for these financial products and, even better, secure them at lower interest rates. This translates to significant savings over the life of your loan or credit card, freeing up your hard-earned money for other goals.

A new paradigm: The benefits of generative AI

- Generative artificial intelligence (AI) isn’t typical AI. Forget predefined rules and patterns—this cutting-edge technology empowers machines with the ability to think outside the box. Through advanced algorithms and deep learning, generative AI devours mountains of data, gleaning insights and unlocking a hidden world of creative potential. Think of it as a machine muse, capable of conjuring up new ideas, content, and solutions on its own.

- The financial landscape is witnessing a transformative shift, fueled by the burgeoning power of artificial intelligence (AI). In the realm of business credit, generative AI emerges as a game-changer, streamlining crucial processes and enhancing decision-making capabilities. This innovative technology automates tasks like credit scoring, fraud detection, and risk assessment, freeing up valuable human resources and enabling unparalleled efficiency.

- Traditional credit scoring methods often provide a limited view of a borrower’s financial health. However, the emergence of advanced algorithms and Large Language Models (LLMs) is transforming the landscape, empowering lenders with deeper insights and a more comprehensive understanding of creditworthiness.

- For decades, credit scoring has been a tedious manual process, relying on the expertise of financial analysts. This method, while providing valuable insights, comes with significant drawbacks:

-

- Time-consuming: Analyzing extensive financial data point-by-point is a slow and laborious process, leading to delays in loan approvals and impacting the customer experience.

- Prone to errors: Human oversight is inherently susceptible to mistakes, potentially leading to inaccurate credit assessments and financial losses.

- Generative AI can automate credit scoring to a remarkable extent, eliminating the need for manual intervention. This is achieved through the use of advanced algorithms and machine learning techniques, allowing the system to:

- Analyze vast amounts of data: Unlike humans, who are limited in processing capacity, AI can sift through enormous datasets, including credit reports, financial statements, social media activity, and more.

- Identify hidden patterns: It can uncover subtle patterns and relationships in the data that might be invisible to human analysts, leading to a deeper understanding of borrower risk profiles.

- Generate accurate credit scores: Based on the comprehensive data analysis, It can generate credit scores for each applicant with a high degree of accuracy, reducing the risk of financial misjudgments.

Beyond the credit score: Generative AI is reshaping risk assessment. This paradigm shift unlocks a multitude of advantages, including:

-

- Holistic Understanding: By analyzing diverse data sources, these technologies provide a 360-degree view of a borrower’s financial situation, capturing not only their credit history but also their overall financial behavior.

- Increase efficiency: Automating the process streamlines loan approvals, significantly reducing turnaround time and improving the customer experience.

- Enhance accuracy: AI-powered analysis leads to more accurate credit scores, minimizing financial risk for lenders and improving credit access for borrowers.

- Reduce costs: Automation eliminates the need for manual labor, leading to significant cost savings for financial institutions.

- Improve compliance: The LLM model ensures compliance with regulations by incorporating relevant data points and adhering to established scoring methodologies.

- Transparency and Trust: Generative AI models are transparent in their decision-making processes, providing borrowers with clear insights into how their creditworthiness is evaluated. This builds trust and confidence, fostering more successful lending relationships.

- Successful Lending Relationships: Building trust and providing fair access to credit, paves the way for more successful lending relationships. This benefits both borrowers and lenders, promoting a more inclusive and robust financial ecosystem.

- Fraud Detection: Generative AI systems are equipped with the remarkable ability to analyze vast amounts of data and discern hidden patterns. This enables them to identify anomalies in transactions, such as unusually large purchases or suspicious activity from new accounts. By analyzing and comparing historical data with real-time transactions, generative AI can recognize deviations from normal patterns, alerting credit departments to potential fraud before it escalates into a major issue.

Take Away:

- In an era defined by Generative AI, banking and financial institutions stand poised to unlock a wealth of revenue-generating and cost-saving opportunities. These technologies promise increased automation and, when implemented cautiously, enable faster, risk-based credit decisions and dramatically improved customer service.

- However, unlocking the full potential of Generative AI requires domain expertise to bridge the gap between generic AI technology and domain-specific data, knowledge, and methodologies. Inaccurate data analysis can lead to significant pitfalls, so careful consideration is crucial.

- Despite the immense potential of Generative AI, its successful integration into business lending demands a keen eye for ethical and regulatory implications. Transparency, fairness, and accountability must be cornerstones of any AI deployment, ensuring compliance with relevant laws and regulations.

- Dive deeper with our Aarav expert team, where you can test-drive GenAI solutions tailored to your specific financial challenges. From fraud detection to personalized wealth management, see how GenAI can tangibly transform your business.

Let’s explore FinTech innovation together. Connect with @Aaravsolutions

About Author:

Dinesh Suthar

Principal Architect-Product Engineering & Innovations | Aarav Solutions

Dinesh is passionate about continuously challenging the status quo in support of adopting innovative approaches and technologies. He holds more than 19 years of experience as a software professional, innovator, and leader designing E2E architecture, building complex application software/product, team building & mentoring, project budgeting, oracle database management, data migration, IT automation, designing solutions for OSS-BSS domains & oracle BRM in various industries like Broadband, VOIP, WIFI, Telecom, Digital Cable TV, Utility services, OTT. He enables key initiatives & organizations’ technology vision using innovative, emerging & results-oriented technologies like Cloud-native Microservices, CI/CD, IoT, AI, Hyperlegdger Blockchain. As Principal Architect for Adptx Suite products by Aarav Solutions, he designed end-to-end and led the product team to bring emerging technologies as an integral part of the Adptx Suite Subscriber management solution.