O2C or OTC is another synonym for Order To Cash that plays a crucial role in defining the success of an organization. It drives the relationship with the customer from the period of their acquisition to the payment logged in the accounts. By leveraging such remarkable benefits of the Order to cash cycle will minimize errors, avoid delays, and ensure high-performing data that could maximize an impact on an organization.

According to a BCG report on Order to Cash platforms, companies that deploy orders to cash platforms and re-engineer the process could boost revenues by 1% to 3% in a year. Let’s understand the process and how its numerous benefits could be achieved by leveraging it in all aspects of the business.

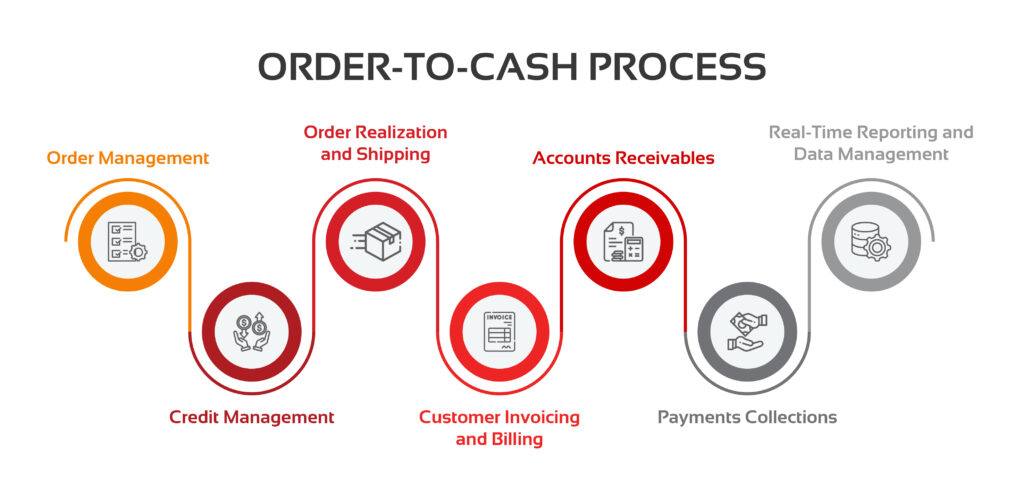

1. Order Management:

As it is the very first phase of the O2C process, it begins with an order placement by a customer. No matter what the platform is either online i.e. website, social media, e-commerce, etc or offline i.e. sales representatives, events, etc this function manages everything as soon as the order is placed. Since it is fully automated, on-the-spot notifications are pushed with a series of steps to be taken by different departments in an orderly manner.

2. Credit Management:

In order to cut down the errors that occur for fulfilling the order, wherever the credit policy is applicable for the customer, the O2C process will automatically push a credit approval. Automated software will manage everything from credit limit approvals to denials and send a notification for clever review to the authorized departments. Such seamless automation manages accounts receivable easier and strategic credit guidelines to ensure customer satisfaction.

3. Order Realization and Shipping:

The software helps to automate inventory management like the important components required to fulfill the order, update the sales team, avoid order shipment delays, etc. Real-time tracking is made possible as if any order is out-of-stock or damaged or less inventory is present then the immediate notification is pushed for alert and avoid issues.

The shipping procedure is also covered under the O2C process and updated to the shipping team so that they can schedule their shipments’ carrier pickup on time and high-performance standards could be maintained.

4. Customer Invoicing and Billing:

Entire organizational cash flow gets affected when any delays or inaccuracies occur. Accurate invoicing helps the finance department to plan the cash structure more efficiently for forecasting expenses and revenues. Precise costs, credit limit, order specifications, order dates, shipping dates, everything is covered under the O2C process and accurate information is sent without delays.

5. Accounts Receivables:

Automated accounting software helps to pre-set the time before the deadlines and invoices are pre-determined to avoid obvious errors that result in payment delays. As per organization policy, an automated date and time are set for a reminder that triggers an automated payment indication with an invoice review.

6. Payments Collections:

Many backlogs have been observed while making payments like sometimes amounts not processed in the ordering system or sometimes processed but not reflected in the system. This leads to inaccuracy of cash estimates that causes financial inconvenience. For any overdue payments, the credit period should be put on hold and reflected immediately so that outlining the collection procedure penalties move forward. This automated system helps to alert the customer that payments need to be sent before the overdue and the next purchase cycle could begin freely.

7. Real-Time Reporting and Data Management:

All these interconnected software track the real-time insights at every phase of the customer journey and showcase highly accurate data. This data could be monitored and analyzed to know the overall flow of the O2C process and how it is affecting the activities in an organization. Such data analytics helps organizations to deliver value to their customers by knowing at which phase how much efficiency is required and improvements could be done.

Advance your Order To Cash Cycle!

According to a study by IBM, companies that adopted best-in-class Order to Cash practices were 81% more effective at order management than those that had not. Choosing the right software for data collection and its analyses of the key metrics that are uncovered helps businesses to gain insights. By automating the process, the backlogs could be identified prior and seamless execution is examined. Order to Cash cycle requires phenomenal teamwork across multiple functions like accounting, financing, credit period, collections, and more.

Aarav Solutions will help in optimizing the order to cash cycle by setting ground-breaking standards, real-time accounting software, data collection and its analysis, technology as core, and more. Connect with us and resolve the challenges you are facing in process integration, tech-enabled systems, data security, cloud-based configuration, order accuracy, compliance maintenance with regulations and industry standards, and more for avoiding consumer dissatisfaction.

Get in touch with our team of industry experts and understand more about Order to cash and how you can leverage it for your business success.

Know more about us from