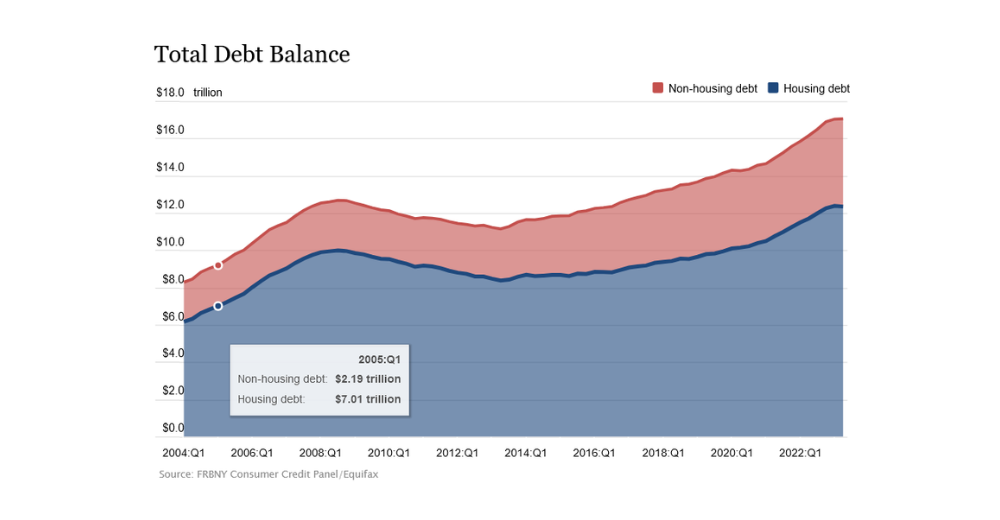

In recent times, household debt has reached alarming levels, with a total of $17.06 trillion in Q2 2023, as reported by the New York Federal Reserve. One significant factor contributing to this surge is the increase in credit card balances, which have hit a record high of $1.03 trillion. While mortgage balances have remained stable at $12.01 trillion, other types of loans, such as auto and retail credit, have also witnessed substantial growth.

The Impact of Household Debt:

Before we delve into the credit history part, it’s crucial to understand what is household debt and the impact of rising household debt.

Household debt, or family debt, encompasses loans taken out for things like homes, education, cars, and various expenses. When household debt becomes too high, it can put a lot of pressure on individuals and families. This financial burden can lead to instability and stress, making it tough to afford essential things and save for the future. In extreme cases, it can even contribute to economic problems for an entire country. So, dealing with household debt is not only crucial for personal financial well-being but also for the overall economic health of a nation.

Credit History Basics:

Understanding how credit history works is essential, as it plays a crucial role in your financial life. Different credit evaluation companies have their own methods of assessing credit history. Non-Banking Financial Companies (NBFCs) may even employ proprietary algorithms that analyze your bank statements. Knowing how standard credit reports present information can help you maintain a strong credit profile and expedite loan approvals.

Maintaining Your Credit History:

If you’re planning to apply for a business loan, regularly checking your company’s credit history and score every three to six months is advisable. This practice allows you to gauge the impact of your financial actions on your credit reports. It’s also important to take heed of the following tips to prevent loan application rejections:

- Avoid co-signing someone else’s loan application, as being a guarantor on a defaulted loan can harm your own loan prospects.

- Steer clear of derogatory remarks on your credit report, as they can negatively affect your loan proposal, even with a good credit score.

- Ensure timely filing of income tax returns for at least two years.

- Compile necessary paperwork, including business plans, financial projections, business credit reports, and bank statements, to enhance your chances of loan approval.

Why Credit History Matters:

In today’s economy, characterized by rising household debt, maintaining a favorable credit history is not just a choice; it’s a necessity. A strong credit rating can lead to better loan interest rates, higher credit limits, and more favorable mortgage terms. Lenders scrutinize your credit history as a financial report card before providing monetary assistance.

Your credit history affects various aspects of your life, including:

- Loan qualification and loan terms, such as interest rates, credit limits, and monthly payments.

- Insurance rates set by insurance companies.

- Apartment lease applications, as landlords review your credit.

- Utility account setups, where credit history may determine the need for a security deposit.

- Employment decisions, with some employers checking credit reports before hiring.

- For small businesses, a robust credit history is essential for securing funding and reducing borrowing costs, ultimately improving financial stability.

Access to Money Markets:

A solid credit history not only opens doors to loans and credit cards but also grants access to broader money markets. Whether it’s issuing commercial paper or attracting investment for future projects, a high credit rating significantly reduces capital costs. This empowers both individuals and businesses to participate in investment opportunities typically reserved for institutional players.

Aarav’s Contribution:

Aarav Solutions has played a vital role in enhancing credit reporting systems by collaborating with Equifax, a global data analytics and technology company to streamline its operations. Leveraging our top-notch IT solutions, we’ve improved Equifax’s data processing capabilities, making their credit reporting more accurate and faster. This, in turn, enhances the credibility of credit scores, benefiting lenders and borrowers alike.

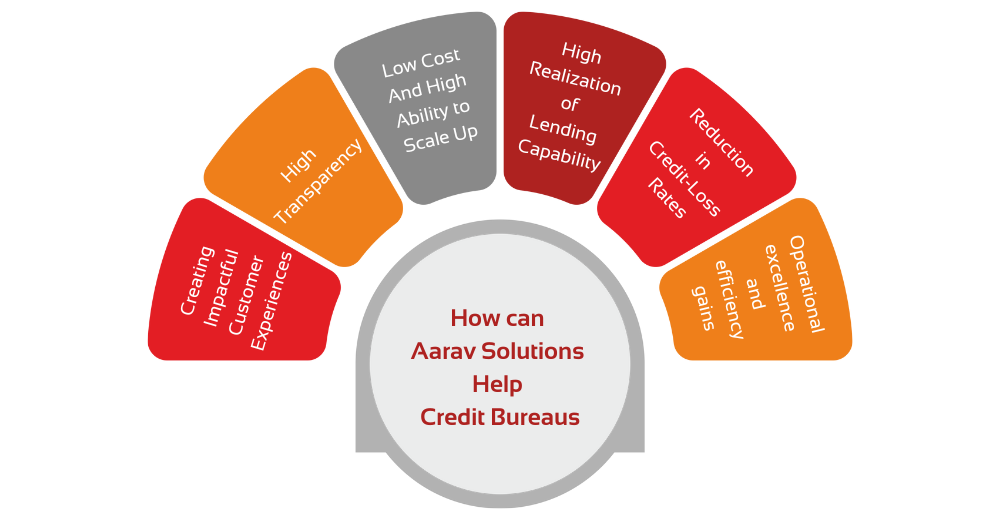

How Aarav Can Assist Credit Bureaus:

Credit bureaus are crucial in collecting and disseminating financial histories, and managing this vast data efficiently is paramount. Aarav excels in modernizing and automating complex systems, enhancing the integrity and speed of the credit scoring process. Our extensive experience in managed services ensures effective system development and maintenance, ensuring high availability and disaster recovery. In the credit business, time is of the essence, and our customer support is designed to address issues promptly.

Conclusion:

In a world where household debts are on the rise, the significance of a reliable credit history cannot be overstated. As a technology partner, Aarav Solutions is committed to improving the reliability and efficiency of credit reporting systems. If you’re considering upgrading your credit bureau’s systems and operations, we invite you to connect with us today to explore our financial solutions.